Describe the Process Companies Use to Raise Equity Capital

We provide a variety of financing options for portfolio companies ranging between direct equity and short term debt. Non-Disclosure Agreements probably dont make sense for start-ups trying to raise funding from venture capital investors as most venture capitalists will refuse to sign such agreements.

8 Describe the Income Statement Statement of Owners Equity Balance Sheet and Statement of Cash Flows and How They Interrelate.

. We invest across the cannabis ecosystem. What We Look For. Viridescents executive team brings over 60 years of capital markets experience and over 20 years of direct cannabis industry experience.

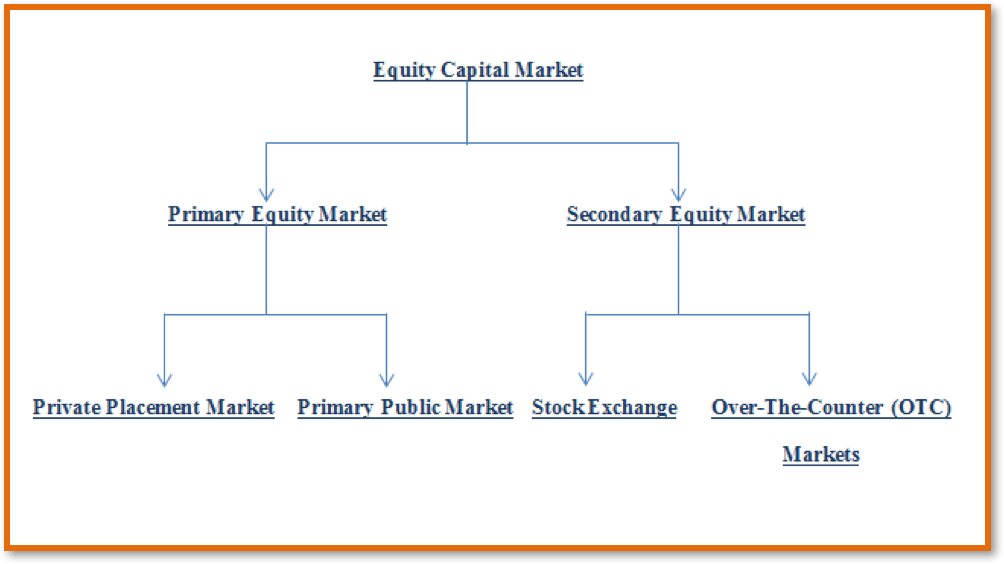

We invest across the cannabis ecosystem. An initial public offering IPO is the first time that the stock of a private company is offered to the public. A general partner is an individual or an entitytypically affiliated with a venture capital firm private equity firm or other investment firmthat raises money from limited partners for a private fund organized as a limited partnership and that both invests in and manages the fund.

Among cities Mumbai-based companies retained the top slot with 108 private equity investments totalling almost US 6 billion in 2007 followed by DelhiNCR with 63 investments US 27 billion and Bangalore with 49 investments aggregating US 700 million. Initial Public Offering - IPO. The study of accounting requires an understanding of precise and sometimes complicated terminology purposes principles concepts and organizational and legal structures.

It will use 40 debt and 60 equity. Business growth requires an injection of capital that is obtained from investors. US VCs raised 738B in Q1 2022 and invested 707B across 3723 startup deals down from 77B invested across 4282 deals in Q1 2021 The US.

The process begins with the firm deciding how much they need for the expansion. We have addressed the owners value in the firm as capital or owners equity. Companies may raise different funding rounds using different.

Private equity analyst is an equity analyst who looks at companies that are undervalued so that a private equity investor can buy the company take it private and earn profits. The offering memorandum is part of the investment process. What is the total amount of capital that will need to be raised to finance the expansion project.

Generally speaking equity is the value of an asset less the amount of all liabilities on that asset. Flotation costs will be 3 for debt and 9 for equity. The United Kingdom is one of the quickest locations to incorporate with a fully electronic process and a very fast turnaround by the national registrar of companies the.

A sole proprietorship on the other hand cannot claim a capital loss greater than 3000 unless the owner has offsetting capital gains. Venture industry raised 738 billion last quarter more money than in any other previously announced three-month period and more than the total for most full years. 4 Microsoft Word - The VC Handbook -- _Chapter 0-26_ - PVIA02_VentureCapitalIndustryinIndiapdf accessed March.

It can be represented with the accounting equation. For instance a company may decide to increase the number of its offices which will require a significant amount of funds. A fund that is organized in a.

PitchBook and NVCA data. The importance of this asset class continues to grow on a global scale because of the need for equity capital in developed and emerging markets technological innovation and the growing sophistication of electronic information exchange. However later we switch the structure of the business to a corporation and instead of owners equity we begin using stockholders equity which includes account titles such as common stock and retained earnings to represent the owners interests.

Private equity can be broadly defined as investment in the private unlisted companies by assuming higher risks and hoping for substantial returns. The companys after-tax cost of debt is 5 and the cost of equity is 125. Equity securities play a fundamental role in investment analysis and portfolio management.

In Romneys version of the tale Bain Capital which evolved into what is today known as a private equity firm specialized in turning around moribund companies Romney even wrote a book. The process of incorporation is generally called company formation. Private Equity Analyst Guide.

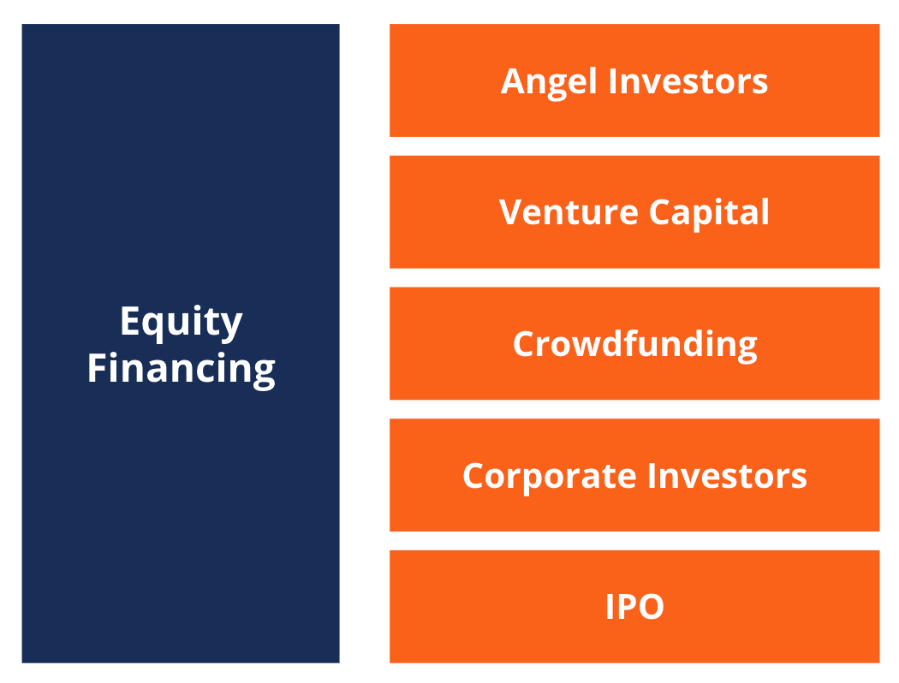

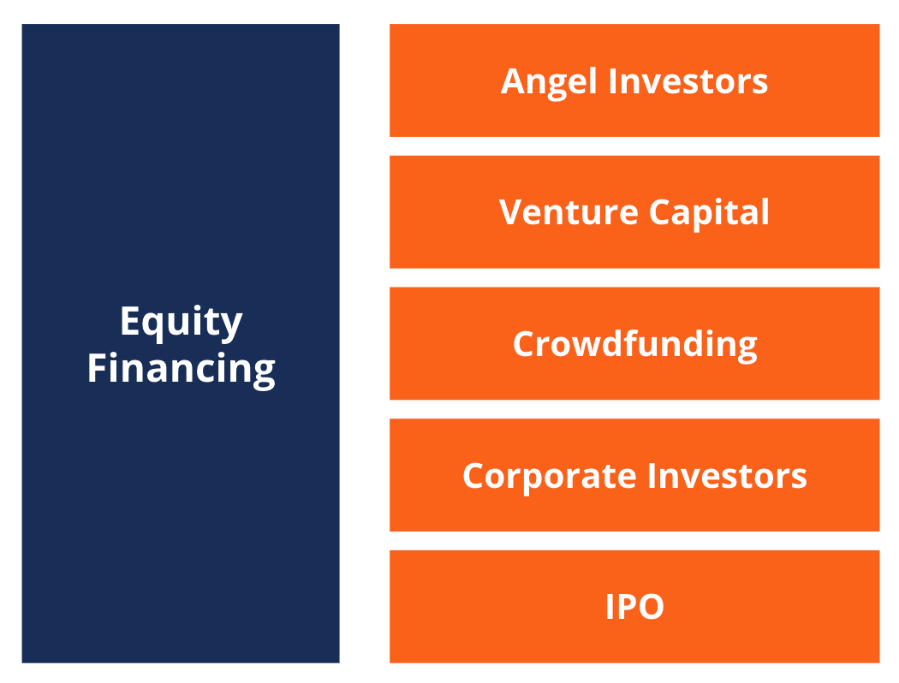

Equity Financing Overview Sources Pros And Cons

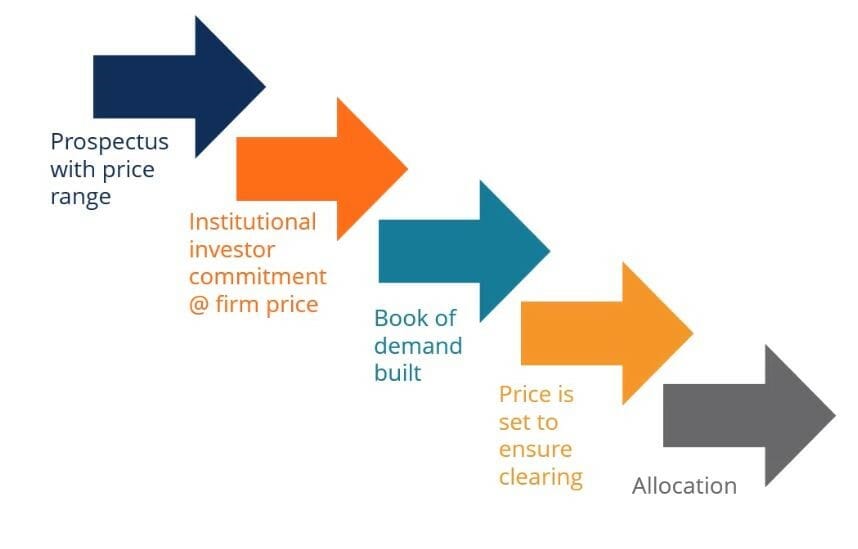

Capital Raising Process Understand How Capital Raising Works

No comments for "Describe the Process Companies Use to Raise Equity Capital"

Post a Comment